Revolutionize Gold Trading Using FintechZoom Updates

You’ve probably heard the buzz about the gold market lately. It’s more than just a precious metal; it’s a global economic barometer, an investment, and a hedge against uncertainty. But have you ever thought about how technology is reshaping the way we track gold prices?

Enter FintechZoom, a revolutionary platform that’s transforming the gold market with its real-time tracking and analysis. This isn’t your grandfather’s way of investing in gold. This is the future, where technology meets finance, and where you’re always one step ahead.

In the following article, we’ll delve into the world of FintechZoom and understand how it’s revolutionizing the gold market. Buckle up, because you’re about to embark on a golden journey like no other.

Overview of Gold Price Trends

Your understanding of the significance and fluctuations in the gold market can be enhanced by studying historical and recent trends in gold prices. The FintechZoom platform enriches your view into these shifts.

Historical Gold Price Analysis

A delve into the past trends of gold prices reveals the precious metal’s resilience and luster. In times of global turbulence, gold’s appeal as a safe-haven investment soared. Two notable instances in the 20th century – the Great Depression in the 1930s and the high inflation period of the late 1970s – saw significant spikes in gold prices. Statistics from FintechZoom provide reliable data to support this; the gold price rose by over 24% during the Great Depression, while the late 70s bull run saw gold exploding by over 600% in just a few years.

The past two decades have also seen some interesting movements in gold prices. Since the start of the 2000s, the gold price FintechZoom’s data shows appreciation, driven by factors such as economic recessions, geopolitical tensions and global health crises.

Recent Gold Price Dynamics

In studying the recent dynamics of gold prices, FintechZoom’s real-time tracking and analysis comes in handy. In 2020, gold prices hit a record high, driven by market uncertainties around the global pandemic. However, in 2021, with nations coming to grips with the health crisis and economies gradually reopening, gold prices have experienced some easing.

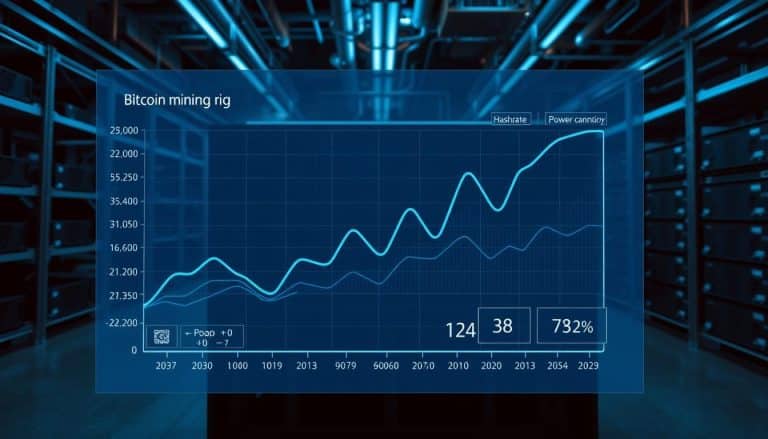

Interestingly, the emergence of Bitcoin and the broader cryptocurrency market has led to fascinating dynamics. As FintechZoom’s crypto coverage has extensively documented, digital currencies have presented a new form of ‘digital gold’, creating a competitive landscape for traditional gold as a store of value. Observing the interplay between gold and cryptocurrencies offers novel insights into the changing dimension of safe-haven investments.

Knowledge of historical trends and staying abreast of recent dynamics in gold prices can enrich your investment decisions. The advancements of platforms like FintechZoom, with their comprehensive coverage, make this task far more accessible for the investor. Remember, historical performance isn’t an exact map to future outcomes but can serve as an essential part of your investment toolkit.

Impact of Fintech Innovations on Gold Pricing

Leveraging the capabilities of modern technology, fintech platforms have brought about significant change in financial market operations. Particularly, their role in gold pricing has marked a new era in investment strategies. Let’s explore further the dynamics of these impacts.

Role of Fintech Platforms

Revolutionizing the modus operandi of the financial world, fintech platforms contribute substantially to the course of pricing. Notably, FintechZoom stands out with its proficiency in tracking and evaluating gold prices in real-time. FintechZoom expedites the process of investment decision-making with its intuitive interface and actionable insights. Taking for instance the gold price FintechZoom feature, it offers insightful data catering specifically to gold investors. It’s a hub where traders gather real-time data, observe trends and make informed investment decisions accordingly.

Predictive Analytics and Gold Prices

The advent of predictive analytics in financial technology is nothing short of a game-changer. Platforms like FintechZoom harness these analytics to predict future shifts in gold pricing. By analyzing historical data, they create statistical models to project possible outcomes. These model-led insights then guide investors to adapt their strategies accordingly. For instance, during the historical events like the Great Depression and the late 1970s inflation period, analytic predictions would have been invaluable.

The incorporation of predictive analytics in fintech platforms has hence, turned the tides of traditional gold trading. It has not only facilitated knowledgeable decision-making but also armed the investors with an edge for weathering financial storms. By transitioning to platforms like FintechZoom for real-time data tracking and predictive analytics, an investor navigates the volatile waters of gold pricing, thereby gaining a superior investing advantage.

How Fintechzoom Covers Gold Prices

Gain insight into Fintechzoom’s comprehensive examination of gold prices. This platform strides ahead with breakthrough technological features, setting the bar for financial platforms globally.

Accuracy and Timeliness

In the fast-paced world of financial markets, Fintechzoom ensures precision and punctuality. Rapid market changes don’t slip past; with its superior technological infrastructure, Fintechzoom updates gold prices in real-time. Data integrity is of paramount importance to Fintechzoom. As a portal, it confirms information accuracy using sophisticated algorithms before displaying gold prices. For instance, if there’s a disparity between the data Fintechzoom receives and the statistics from trustworthy sources, an alert is triggered, cutting down on data discrepancies drastically. Thus, Fintechzoom boasts a high degree of accuracy while delivering information promptly.

Comparison with Other Financial Platforms

Compare Fintechzoom with other financial platforms, and it’s clear why it’s a go-to for many investors. Unlike its counterparts, Fintechzoom doesn’t merely provide stock prices; it supplements the data with relevant news, including shifts in the economic landscape or corporate actions that can influence gold prices. Each gold price update goes hand-in-hand with context, enabling investors to make informed decisions.

Fintechzoom stands staunch against platforms like Nasdaq FintechZoom or Dow Jones FintechZoom which primarily focus on stock exchange data. Users seeking comprehensive gold market insights don’t need to surf multiple websites because Fintechzoom offers up-to-date gold prices along with relevant news, expert perspectives on market trends, and robust predictive analysis.

Furthermore, Fintechzoom Pro takes this a step further by providing exclusive access to premium insights and personalized analysis. As a result, whether comparing Fintechzoom with FTSE 100 FintechZoom or Apple Stock FintechZoom, this platform ensures detailed coverage of the gold market like none other.

Investment Strategies Based on Gold Prices

It’s crucial to delve into the realm of investment strategies rooted in the fluctuations of gold prices. Harnessing the power of accurate and real-time data from platforms such as FintechZoom can assist investors in formulating effective game plans.

Long-term Investment Approaches

In the world of investing, long-term strategies often involve observing cycles and trends over extended periods. It’s crucial to make decisions based on a variety of factors including market dynamics, geopolitical sentiments, and financial policies. FintechZoom Pro is a premium service that offers personalized analysis, ideal for investors seeking insights for long-term gold investments.

When it comes to long-term strategies in the gold market, buying and holding gold ETFs (Exchange Traded Funds) is one popular pathway. Monitoring trends over longer timescales, such as 5-10 years, gold ETFs can act as an inflation hedge and a defensive play during periods of market stress.

Another long-term approach is to invest in gold mining stocks. These stocks reflect the profitability of the gold mining company instead of the commodity’s price itself. As gold prices rise, you may expect an increase in mining profitability, thereby leading to higher stock prices.

Short-term Trading Tips

Explore the avenue of short-term trading if you’re more inclined towards swift market actions. Such a style seems more appropriate if you keenly follow gold price movements on platforms such as FintechZoom, where real-time data can direct immediate buying or selling decisions.

For short-term trading, less conventional routes like trading in gold futures contracts are becoming more common. These contracts allow you to negotiate a set price for gold at a future date, speculating on the short-term price increments.

Gold options, another derivative, are also significant for short-term trades. Options provide the opportunity to take a position on future price movements without having to hold the physical asset.

Finally, swing trading is another viable short-term strategy. It’s a technique that aims to capture gains in a stock or commodity within an overnight hold to several weeks. You can set your specifications on the FintechZoom platform and align your swings to the ups and downs of the gold market.

Remember, whether you choose long-term investment approaches or short-term trading tips, a strategic blend of both can create a balanced portfolio. Always keep an eye on FintechZoom’s real-time gold prices for accurate and up-to-date market information.

Conclusion

You’ve journeyed through gold’s historical significance and its modern role in investment strategies. You’ve seen how FintechZoom has transformed gold market analysis, providing you with the tools to make informed decisions. It’s clear that a blend of long-term investments and short-term trades, backed by accurate data, can balance your portfolio. By using FintechZoom’s real-time gold prices and market insights, you’re equipped to navigate both calm and turbulent economic waters. Whether you decide to invest in gold ETFs, gold mining stocks, or delve into gold futures contracts and swing trading, remember that the key lies in the blend. Let FintechZoom be your guide in this golden journey.

What historical significance does gold have as an economic indicator and investment?

Gold has been a valued commodity since ancient times, acting as a reliable store of wealth. Especially during periods of economic instability, it cements its status as a hedge against inflation and currency depreciation. Its comparison to modern-day cryptocurrencies like Bitcoin further testifies to its enduring relevance.

How is FintechZoom revolutionizing gold market analysis?

FintechZoom offers advanced technology features and provides real-time updates for the gold market. This accurate and timely data is crucial for investors to make informed investment decisions.

What are the long-term investment strategies based on gold prices?

Long-term investment strategies in the context of gold involve investments in Exchange-Traded Funds (ETFs) and gold mining stocks. These investments are less affected by short-term price fluctuations and give investors exposure to the gold market.

What are the short-term trading strategies involving gold?

Short-term trading strategies with gold involve trading gold futures contracts and options, or engaging in swing trading. These techniques allow investors to take advantage of small price fluctuations in the gold market.

What is the advantage of blending long-term investments and short-term trading strategies?

Balancing long-term investments and short-term trading strategies helps to ensure a well-rounded portfolio. While long-term investments offer stability, short-term trades can bring quick profits. Relying on platforms like FintechZoom for real-time gold price updates is pivotal to strategize accordingly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  PayPal USD

PayPal USD  Dai

Dai  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe