Decoding XRP’s Future: Expert Analysis Reveals Trends

Are you curious about what the future holds for XRP? Dive into the world of technical analysis to uncover valuable insights that can help you gauge XRP’s future performance. By examining historical price data and market trends, you can gain a deeper understanding of where XRP might be headed next. Technical analysis offers a unique perspective that can assist you in making informed decisions when it comes to trading or investing in XRP. Stay ahead of the curve by harnessing the power of technical analysis to navigate the complexities of XRP’s market dynamics.

Understanding Technical Analysis

When delving into technical analysis for XRP, you’re essentially studying past market data to forecast potential future price movements based on historical patterns. By examining price charts and trading volumes, you can identify trends that may help you make informed decisions when trading or investing.

Key Aspects of Technical Analysis

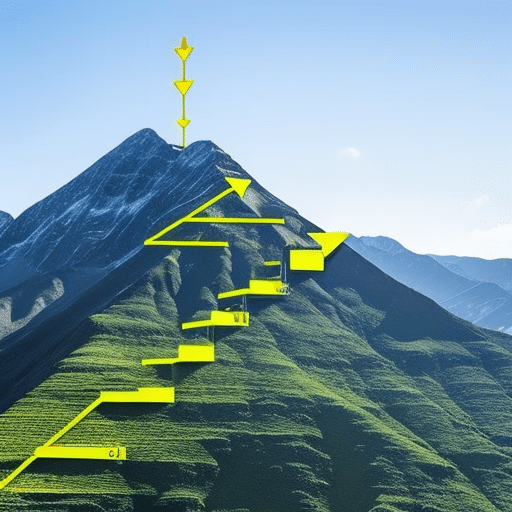

- Price Trends: Analyzing how XRP’s price has moved in the past can offer valuable insights into potential future direction.

- Support and Resistance Levels: These levels indicate where buyers and sellers are likely to emerge, helping you anticipate price movements.

- Indicators and Oscillators: Tools like Moving Averages or Relative Strength Index (RSI) can provide additional signals for traders.

- Volume Analysis: Examining trading volumes alongside price movements can confirm the strength of a trend.

Utilizing Technical Analysis for XRP

By incorporating technical analysis techniques into your trading strategy for XRP, you can enhance your ability to make informed decisions, capitalize on potential opportunities, and manage risks effectively. It’s an essential tool in anticipating the future performance of XRP in the dynamic crypto market landscape.

Importance of Historical Price Data

When analyzing historical patterns in XRP price movements, it’s crucial to understand the significance of historical price data. By examining past price data for XRP, you gain valuable insights into XRP’s price behavior over time.

Understanding the impact of institutional investors on XRP’s current market dynamics can also be enhanced through historical price data analysis. It provides you with a comprehensive view of how institutional actions have influenced XRP’s price in the past.

Furthermore, evaluating the role of market sentiment in XRP’s downward trend becomes more insightful when you have access to historical price data. This analysis allows you to identify patterns and factors that have historically contributed to XRP’s price trends, aiding you in making informed decisions.

By recognizing potential catalysts for a turnaround in XRP’s price trajectory through historical data analysis, you can better anticipate future market movements. This strategic approach helps you stay ahead of market shifts and position yourself for potential opportunities.

In addition, identifying key support levels for XRP amidst its downward spiral is essential for you as a trader or investor. Historical price data enables you to pinpoint crucial price levels where XRP has historically found support, guiding you in your trading decisions.

Moreover, conducting a comparative study of XRP’s price decline with previous market cycles using historical data is valuable. This analysis offers you a broader perspective on XRP’s price behavior across different market conditions, enhancing your understanding of its potential future performance.

Analyzing Market Trends for XRP

In analyzing historical patterns in XRP price movements, you gain valuable insights into its behavior and potential future trajectory.

The impact of institutional investors on XRP’s current market dynamics is significant. Understanding their influence can provide clarity on market movements.

Evaluating the role of market sentiment in XRP’s downward trend is crucial. It helps in gauging market participants’ perceptions and emotions towards the asset.

Identifying potential catalysts for a turnaround in XRP’s price trajectory is essential for anticipating future price movements and positioning yourself strategically.

Comparing XRP’s price decline with previous market cycles can offer valuable perspective on its historical performance and potential price patterns.

It’s important to analyze the correlation between XRP’s price and broader market trends to grasp the interconnected nature of the crypto market landscape.

For strategies for accumulating XRP during periods of price weakness, consider cost-averaging techniques and setting target accumulation levels.

Navigating the uncertainty surrounding XRP’s regulatory status is pivotal in understanding its potential future market positioning and impact on its price performance.

Utilize insights from technical analysis to gauge XRP’s future performance effectively. Technical indicators can provide valuable signals for making informed decisions.

Leveraging Technical Analysis for Informed Decisions

When analyzing historical patterns in XRP price movements, you gain valuable insights into potential price trajectories. By evaluating key support levels amidst its downward spiral, you can strategically position yourself for potential price rebounds.

Utilizing technical analysis provides you with a deeper understanding of market dynamics and aids in identifying comparative trends with past market cycles. This comparative study enhances your ability to make informed decisions based on historical data.

Furthermore, analyzing correlations between XRP’s price and broader market trends allows you to assess the cryptocurrency’s position within the market landscape. These insights from technical analysis are essential for gauging XRP’s future performance and making strategic moves in the ever-evolving crypto market.

By incorporating technical analysis into your decision-making process, you can navigate uncertainty and leverage data-driven strategies to anticipate XRP’s future movements effectively.

Conclusion

You now have the tools to assess XRP’s future performance more effectively through technical analysis. By understanding historical patterns, strategic positioning, and correlations with broader market trends, you can make informed decisions. Leveraging these insights will help you navigate uncertainty and anticipate XRP’s movements in the dynamic crypto market landscape. Stay proactive in your analysis and utilize data-driven strategies to stay ahead of the curve.

Frequently Asked Questions

What is the main focus of the article?

The article highlights the significance of utilizing technical analysis to analyze historical XRP price patterns and make strategic decisions based on key support levels and market cycles.

How does technical analysis help in predicting XRP price movements?

Technical analysis allows investors to assess XRP’s market position by comparing trends with past market cycles, understanding correlations with broader market trends, and making data-driven strategies to anticipate future movements effectively.

Why is it important to leverage technical analysis in the crypto market landscape?

Technical analysis helps investors navigate uncertainty and make informed decisions in the dynamic crypto market by analyzing historical patterns and identifying key support levels during downward trends.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe