Maximizing Cryptocurrency Mining Profits: Strategies and Challenges

Curious about the world of cryptocurrency mining profitability? Delving into this dynamic space can be both exciting and rewarding. Whether you’re a seasoned miner or just starting out, understanding the factors that influence mining profitability is key to making informed decisions in this ever-evolving landscape.

In the realm of cryptocurrency, mining profitability hinges on various elements such as the coin’s price, mining difficulty, and operational costs. Navigating these variables can be a challenging yet rewarding endeavor, offering opportunities for financial growth and technological exploration.

As you embark on this journey, exploring the intricacies of cryptocurrency mining profitability can provide valuable insights into maximizing your returns and staying ahead in the fast-paced world of digital currencies.

Understanding Cryptocurrency Mining Profitability

Cryptocurrency mining profitability is a crucial aspect to consider in the world of digital currencies. To achieve success in this endeavor, you need to grasp multiple factors that directly impact your potential returns. By optimizing your understanding of these key elements, you can navigate the dynamic landscape of cryptocurrency mining more effectively.

Factors Affecting Mining Profitability

To enhance your profitability in cryptocurrency mining, you should focus on the following critical factors:

- Coin Price: The price of the cryptocurrency you mine plays a fundamental role in determining your profitability. Higher coin prices generally lead to increased mining rewards.

- Mining Difficulty: Mining difficulty refers to how hard it is to mine a specific cryptocurrency. As the mining difficulty increases, it becomes more challenging to mine coins, potentially affecting your profitability.

- Operational Costs: Considering your operational expenses, such as electricity, mining hardware, and cooling systems, is vital. Monitoring and optimizing these costs can significantly impact your overall profitability.

- Hash Rate: The hash rate of your mining equipment directly affects the number of calculations it can perform per second. A higher hash rate can lead to increased mining rewards.

- Block Reward Halving: Most cryptocurrencies undergo block reward halving at specific intervals, reducing the rewards miners receive. Understanding this event’s timing is crucial for managing your profitability.

- Mining Pool Fees: Participating in a mining pool involves fees that can impact your mining profitability. Be aware of these fees and choose mining pools carefully.

- Market Volatility: Cryptocurrency markets are highly volatile, with prices fluctuating frequently. Monitoring market trends and adjusting your mining strategy accordingly is essential for maximizing profitability.

Maximizing Your Mining Profitability

To optimize your cryptocurrency mining profitability, consider the following strategies:

- Regular Monitoring: Stay informed about market trends, mining difficulty adjustments, and coin prices to make informed decisions.

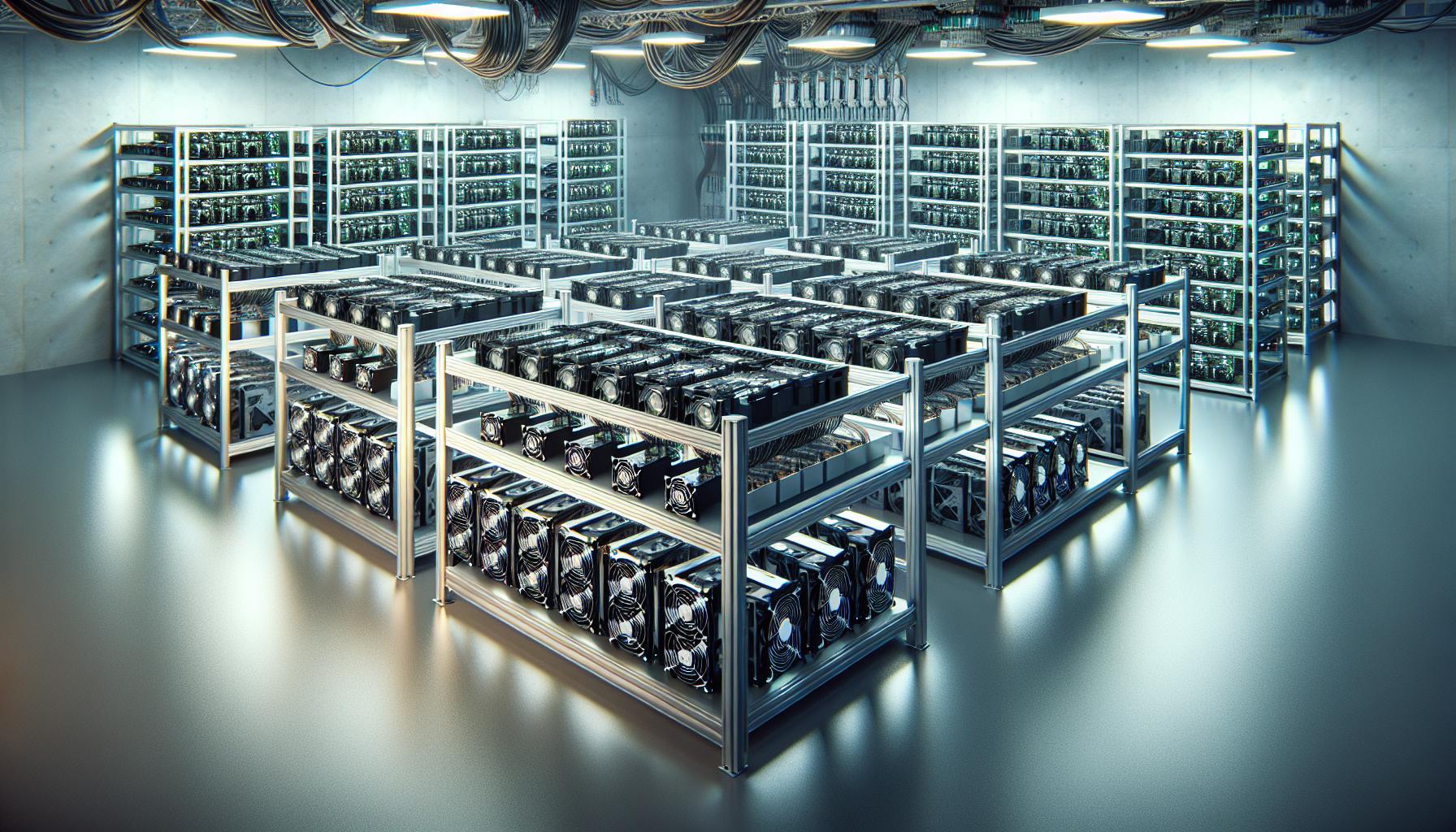

- Efficient Hardware: Investing in energy-efficient mining hardware can help reduce operational costs and increase profitability.

- Diversification: Mining multiple cryptocurrencies diversifies your mining portfolio and hedges against volatility in any single market.

- Cost Optimization: Continuously analyze and optimize your operational costs to maximize profitability.

- Risk Management: Implement risk management strategies to mitigate potential losses due to market fluctuations.

By understanding and leveraging these factors, you can enhance your cryptocurrency mining profitability and position yourself for success in this dynamic industry.

Popular Cryptocurrencies for Mining

When it comes to mining cryptocurrencies, choosing the right coin is crucial for maximizing your profitability. Different cryptocurrencies have varying levels of mining difficulty, block rewards, and market value, which can impact your overall mining success. Here are some popular cryptocurrencies worth considering for mining:

Bitcoin (BTC)

Mining Bitcoin is often seen as the most profitable venture due to its high market value and recognition. However, Bitcoin mining has become increasingly competitive over the years, requiring specialized hardware and significant computational power to be lucrative.

Ethereum (ETH)

Ethereum mining is another popular choice, especially with the upcoming shift to Ethereum 2.0 and the move to proof-of-stake (PoS) consensus. Until the transition is complete, Ethereum mining remains a profitable option for miners.

Litecoin (LTC)

Litecoin is known for its faster block generation times and lower transaction fees compared to Bitcoin. This makes Litecoin mining appealing to miners looking for quicker rewards and lower costs.

Monero (XMR)

For those interested in privacy-focused cryptocurrencies, Monero is a popular choice. Its mining algorithm is designed to be ASIC-resistant, promoting a more decentralized mining environment.

Dogecoin (DOGE)

Dogecoin has gained significant attention in the cryptocurrency world, appealing to both seasoned miners and newcomers. While its value may fluctuate, Dogecoin mining can be profitable during certain market conditions.

Ravencoin (RVN)

Ravencoin is designed for asset transfers on the blockchain, making it unique among cryptocurrencies. Its mining algorithm, X16R, is ASIC-resistant, allowing for more accessible mining opportunities.

Zcash (ZEC)

Zcash offers users the option of shielded transactions, providing enhanced privacy features. Mining Zcash can be profitable, especially for those interested in privacy-centric cryptocurrencies.

Choosing the right cryptocurrency for mining involves considering factors like market value, mining difficulty, and future potential. By staying informed about the latest trends and developments in the cryptocurrency space, you can make informed decisions to maximize your mining profitability.

Strategies to Maximize Mining Profitability

When it comes to maximizing your cryptocurrency mining profitability, you need to focus on several key strategies that can help you make the most of your mining operations. Here are some essential tactics to consider:

Monitoring Crypto Asset Prices Regularly

To stay ahead in the dynamic world of cryptocurrency mining, you should regularly monitor the prices of various crypto assets. Keeping a close eye on market trends and fluctuations can help you make informed decisions about which cryptocurrencies to mine for maximum profitability.

Investing in Efficient Hardware

Investing in efficient mining hardware is crucial for maximizing your profitability. By choosing high-performance hardware with low energy consumption, you can increase your mining output while keeping operational costs in check.

Diversifying Your Mining Portfolio

Diversification is key to reducing risk and increasing profitability in cryptocurrency mining. By mining a mix of different cryptocurrencies, you can spread out your earnings and mitigate the impact of market fluctuations on any single asset.

Optimizing Operational Costs

Optimizing your operational costs is essential for maximizing profitability. By finding cost-effective solutions for electricity, cooling, and maintenance, you can increase your overall mining efficiency and profitability.

Implementing Risk Management Strategies

In the volatile world of cryptocurrency mining, it’s crucial to implement effective risk management strategies. By setting stop-loss orders, diversifying your mining portfolio, and staying informed about market developments, you can protect your earnings and minimize potential losses.

By incorporating these strategic approaches into your cryptocurrency mining operations, you can enhance your profitability and navigate the ever-changing landscape of the crypto mining industry with confidence.

Risks and Challenges in Cryptocurrency Mining Profitability

To maintain a successful cryptocurrency mining operation, you must be aware of various risks and challenges that could impact your profitability. Understanding these factors is crucial for navigating the dynamic landscape of crypto mining effectively.

Market Volatility and Price Fluctuations

Cryptocurrency prices are highly volatile, and they can fluctuate dramatically within a short period. This volatility directly affects mining profitability as it influences the value of mined coins. Sudden price drops can significantly reduce your earnings, while price surges can lead to increased profitability. Being prepared for these market fluctuations is essential for managing risk.

Mining Difficulty and Hash Rate Changes

As more miners participate in securing the network, mining difficulty adjusts to ensure that blocks are mined at a relatively constant rate. Increased mining difficulty can make it harder to mine coins, resulting in lower rewards for your mining efforts. Additionally, changes in the hash rate of the network can impact your mining profitability. You may need to upgrade your mining hardware or adjust your mining strategy to stay competitive.

Operational Costs and Energy Consumption

Operating a mining rig requires substantial energy consumption, especially for Proof of Work (PoW) cryptocurrencies like Bitcoin. High electricity costs can eat into your profits and affect the overall mining profitability. It’s vital to consider energy-efficient mining hardware, renewable energy sources, and optimization techniques to control operational costs and maintain profitability.

Regulatory Challenges and Compliance

The regulatory environment surrounding cryptocurrencies is evolving, and compliance requirements vary across jurisdictions. Changes in regulations or unfavorable legal developments can pose risks to your mining operations. Ensuring compliance with tax laws, reporting requirements, and environmental regulations is necessary to avoid any legal issues that could impact your profitability.

Hardware Failures and Maintenance Issues

Mining hardware is prone to malfunctions, technical failures, and regular maintenance requirements. Downtime due to hardware issues can result in lost mining opportunities and decreased profitability. Implementing proper maintenance routines, monitoring hardware health, and having contingency plans for hardware failures are essential to mitigate these risks.

Conclusion

By proactively addressing these risks and challenges in cryptocurrency mining profitability, you can optimize your operations, enhance your profitability, and adapt to the ever-changing crypto mining landscape effectively. Stay informed, stay prepared, and make informed decisions to secure your mining success in this competitive industry.

Conclusion

Understanding the dynamic landscape of cryptocurrency mining profitability is essential for maximizing your returns. Factors like coin price, mining difficulty, and operational costs play a crucial role in determining your success. By staying informed about hash rate fluctuations, block reward halving events, and market volatility, you can make informed decisions to enhance your profitability. Despite the challenges posed by market volatility, regulatory requirements, and hardware maintenance, adapting to these changes is key to thriving in the cryptocurrency mining industry. Stay proactive, stay informed, and stay adaptable to ensure your mining operations remain profitable in the ever-evolving crypto space.

Frequently Asked Questions

What factors affect cryptocurrency mining profitability?

Cryptocurrency mining profitability is influenced by factors such as coin price, mining difficulty, and operational costs.

What are some critical elements to consider in crypto mining profitability?

Critical elements include hash rate, block reward halving, and market volatility, impacting profitability significantly.

Any strategies to maximize cryptocurrency mining profitability?

Maximizing profitability involves optimizing operational efficiency, leveraging cost-effective resources, and staying informed about market trends.

What are the risks associated with cryptocurrency mining profitability?

Risks include market volatility, increasing mining difficulty, high operational costs, regulatory challenges, and hardware maintenance issues.

Why is it essential to adapt to the evolving crypto mining landscape?

Adapting to changes in the crypto mining landscape is crucial for optimizing profitability and ensuring long-term sustainability in the industry.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe