Understanding XRP Investors’ Mindset During Price Swings

Are you curious about what drives XRP investors during turbulent market conditions? Dive into the intricate world of investor psychology amidst price volatility. Explore the fascinating insights that shed light on the behaviors and decision-making processes of XRP enthusiasts. Discover how emotions, market trends, and personal beliefs intertwine to shape investment strategies in the world of cryptocurrency.

In this article, we unravel the complex web of emotions and rationality that influence XRP investors’ choices in the face of price fluctuations. Gain a deeper understanding of the psychological factors at play when navigating the unpredictable landscape of digital asset investments. Join us on a journey to uncover the motivations and thought processes that drive XRP enthusiasts to make critical decisions in a dynamic and ever-changing market environment.

Understanding XRP Investors’ Behavior

When analyzing XRP’s recovery prospects after legal challenges, it’s essential to consider the factors influencing XRP’s future price trajectory. Your decision-making process must account for potential catalysts for XRP price resurgence, guiding you in navigating uncertainties and strategies for investors during XRP’s price recovery phase.

By anticipating XRP price movements following regulatory clarity, you can develop long-haul perspectives on XRP price rehabilitation that set realistic expectations and timelines. Remember, XRP’s resilience provides insights into its price revival potential, requiring a comparative analysis of its recovery possibilities against other cryptocurrencies.

In the long-term XRP price predictions post-SEC lawsuit, your focus should be on XRP’s comeback journey and its place in the dynamic market environment. Stay informed and agile to make informed decisions amidst XRP’s value forecast amidst regulatory uncertainty.

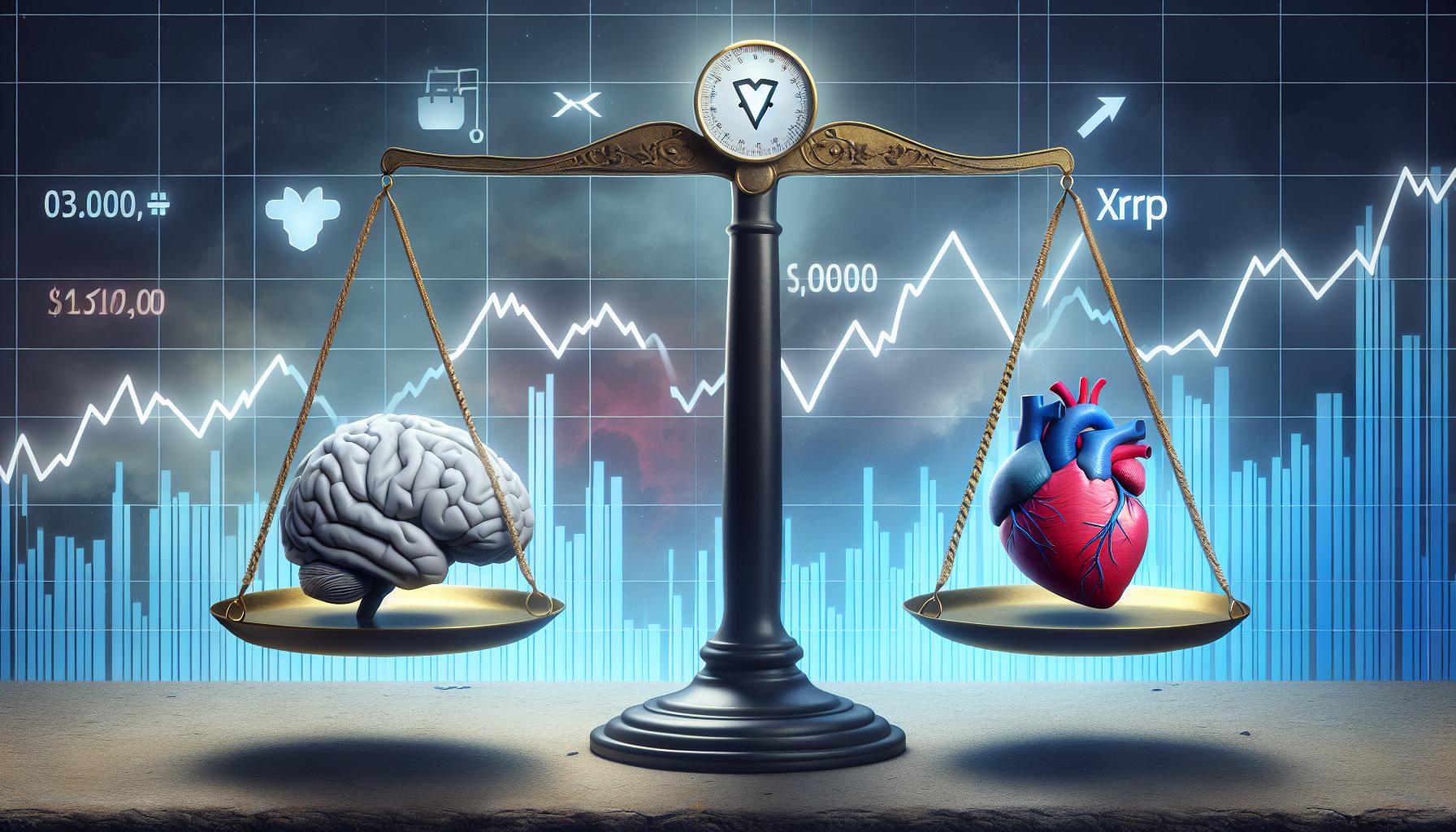

Emotions vs. Rationality in Investment Decisions

When it comes to investing in XRP, emotions can often clash with rational decision-making. As an XRP investor, balancing emotions and rationality is crucial for navigating price volatility.

Key Points to Consider:

- Emotions: Fear, greed, and impulse can cloud judgment and lead to hasty decisions.

- Rationality: Logical analysis of market trends and fundamental factors is essential for making informed choices.

Strategies for Success:

- Stay informed: Keep up with market news and regulatory updates to make sound investment choices.

- Set goals: Establish clear investment objectives to guide your decision-making process.

- Diversify: Spread your investments across different assets to mitigate risk.

Impact on XRP Prices:

- Emotional reactions in the market can amplify price swings and create opportunities for strategic investors.

- A balance between emotions and rationality can help you capitalize on market movements for long-term gain.

- Developing a disciplined approach to investing can enhance your chances of success in the volatile world of cryptocurrency.

Find the sweet spot between emotions and rationality to navigate the ever-changing landscape of XRP investments.

Impact of Market Trends on XRP Enthusiasts

As an XRP enthusiast, being aware of market trends is crucial. Understanding price movements and anticipating shifts can help you make informed decisions. Emotions like fear and excitement may arise during volatile periods, but it’s essential to stay rational.

XRP Price Trends:

- Long-term XRP price predictions post-SEC lawsuit can provide insights for strategic planning.

- Factors like regulatory uncertainty can influence XRP’s future price trajectory.

- Analyzing XRP’s recovery prospects after legal challenges is essential for long-term investing.

Emotional Impact:

- Fear and greed can sway your decisions, but rational analysis is key to successful investing.

- Market volatility can trigger emotional reactions, affecting XRP prices.

- Stay informed about market trends to make well-informed decisions.

- Setting clear investment goals and diversifying your portfolio can help mitigate risks.

Balance emotions with logic to navigate market fluctuations effectively. By understanding and adapting to market trends, you can make sound investment choices in the world of XRP.

Personal Beliefs and Investment Strategies

When it comes to navigating XRP price recovery amidst market volatility, it’s crucial to consider your personal beliefs and investment strategies. Here are key aspects to keep in mind:

- Analyzing XRP’s recovery prospects post-SEC lawsuit can help you make informed decisions.

- Evaluate factors influencing XRP’s future price trajectory to strategize effectively.

- Consider XRP value forecast amidst regulatory uncertainty for a long-range perspective on your investments.

- Develop resilient investment strategies to navigate uncertainties and potential catalysts for XRP price resurgence.

- Understand XRP’s resilience to gain insights into its price revival potential compared to peers.

- Anticipate XRP price movements following regulatory clarity for a well-rounded investment approach.

Stay informed, assess the market landscape, and align your beliefs with sound investment strategies to navigate the XRP price recovery phase effectively.

Conclusion

Navigating the XRP market amidst volatility requires a deep understanding of personal beliefs and strategic investment decisions. Analyzing recovery prospects post-SEC lawsuit and evaluating future price trajectory are crucial. Resilient strategies and grasping XRP’s resilience compared to peers are key. Anticipating price movements post-regulatory clarity is vital for a well-rounded approach. Stay informed, align beliefs with strategies, and prepare for potential catalysts in the XRP price recovery phase.

Frequently Asked Questions

What is the key takeaway from the article?

The article emphasizes the importance of personal beliefs and investment strategies in navigating XRP’s price recovery amidst market volatility.

How can investors assess XRP’s recovery prospects post-SEC lawsuit?

Investors can evaluate XRP’s recovery prospects by analyzing factors influencing its future price trajectory and considering its value forecast amidst regulatory uncertainty.

Why is understanding XRP’s resilience compared to peers crucial for investors?

Understanding XRP’s resilience compared to peers is crucial for developing resilient investment strategies to navigate uncertainties and potential catalysts for price resurgence effectively.

What is recommended for a well-rounded investment approach regarding XRP price movements post-regulatory clarity?

Anticipating XRP price movements following regulatory clarity is recommended for investors to adopt a well-rounded investment approach.

How can individuals effectively navigate the XRP price recovery phase?

Individuals can effectively navigate the XRP price recovery phase by staying informed, assessing the market landscape, and aligning their beliefs with sound investment strategies.