Explore the Future of Finance with Blaze Coin: Discover secure, blockchain-based online payments and invest in the evolution of money with Blaze Coin.

Secure Your Cryptocurrency Transactions: Blaze Coin offers unparalleled security with decentralized nodes and expert support for global exchanges.

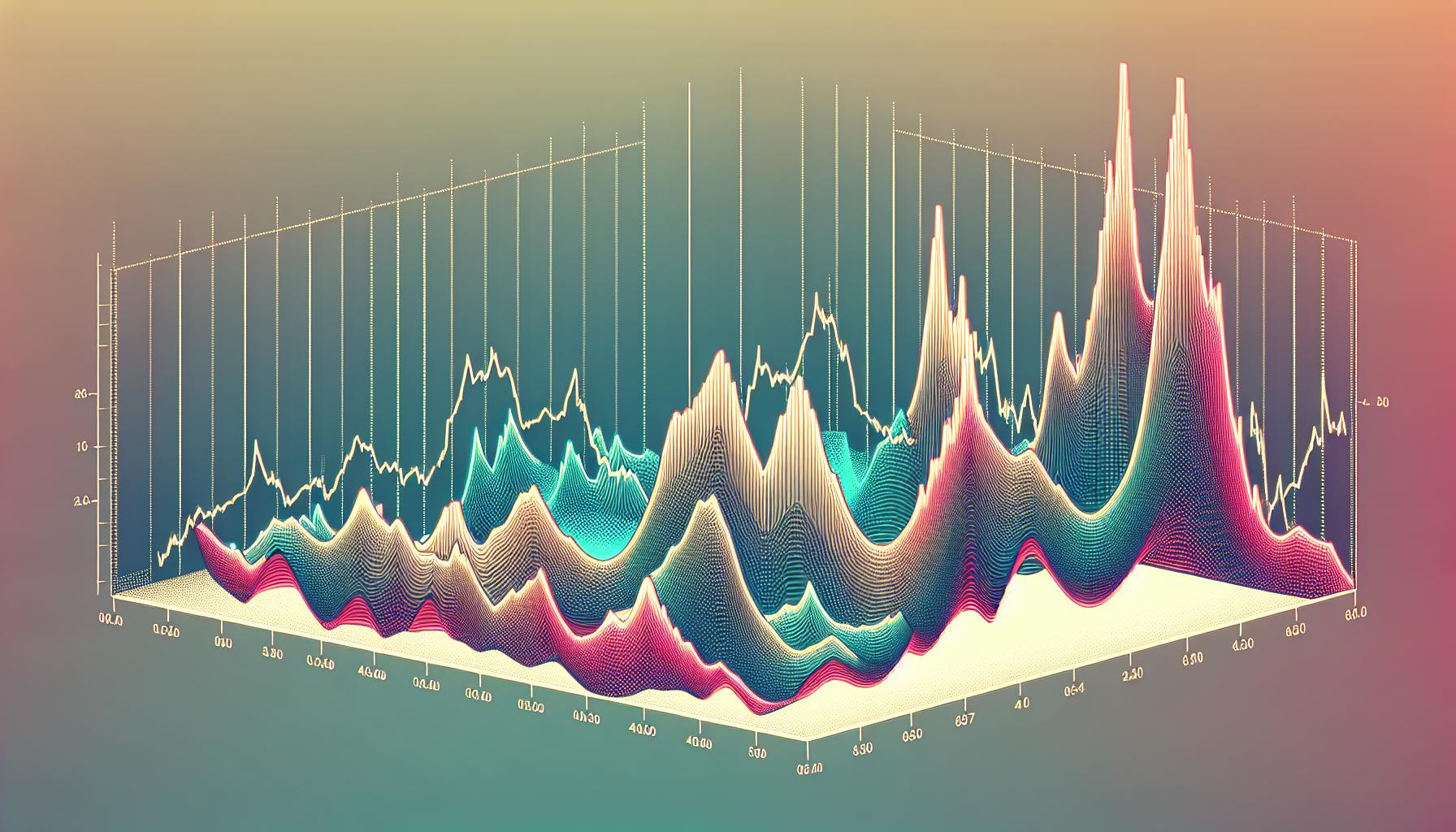

Maximize Your Crypto Investments: Learn how Blaze Coin's margin trading and peak value insights can enhance your cryptocurrency portfolio.

Global Cryptocurrency Exchanges Made Easy: With Blaze Coin, experience hassle-free cross-border transactions and foreign exchange dealings.

Protect Your Crypto Assets: Trust Blaze Coin for the ultimate security of your cryptocurrency keys and wallets.

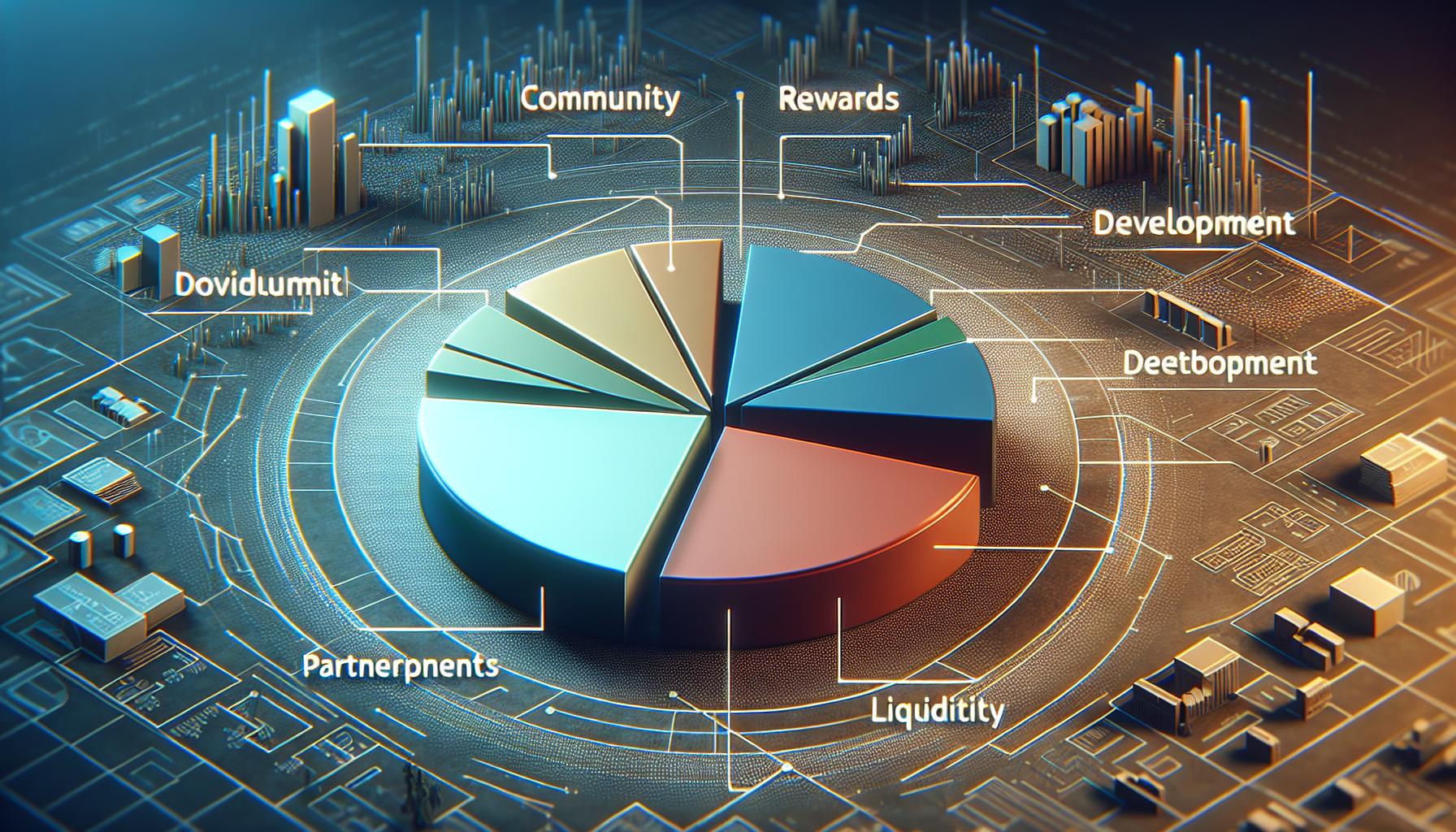

Join the Decentralized Financial Revolution: Embrace the next evolution of money with Blaze Coin's blockchain technology and smart contracts for a transparent, global market.

FOREIGN EXCHANGE DEALERS

Experts who can help you with the transaction even if you have the exchanges going out of the boundaries of a country.

Trade With A Global Market

We can eliminate the need of third party regulator with the help of our smart contracts allowing you to have a registered transaction.

Blockchain to act as online automated surveillance which will make a trade legitimate with a security policy and standards. Perfect way to buy bitcoin.

Crytocurrency Keys & Wallet

With us, you can be sure that you crypto keys and wallets are safe. We strive to ensure that you are aware of your belongings while making sure that you have the people keeping your data safe.

The right people to help keep your information safe.

From Our Blog